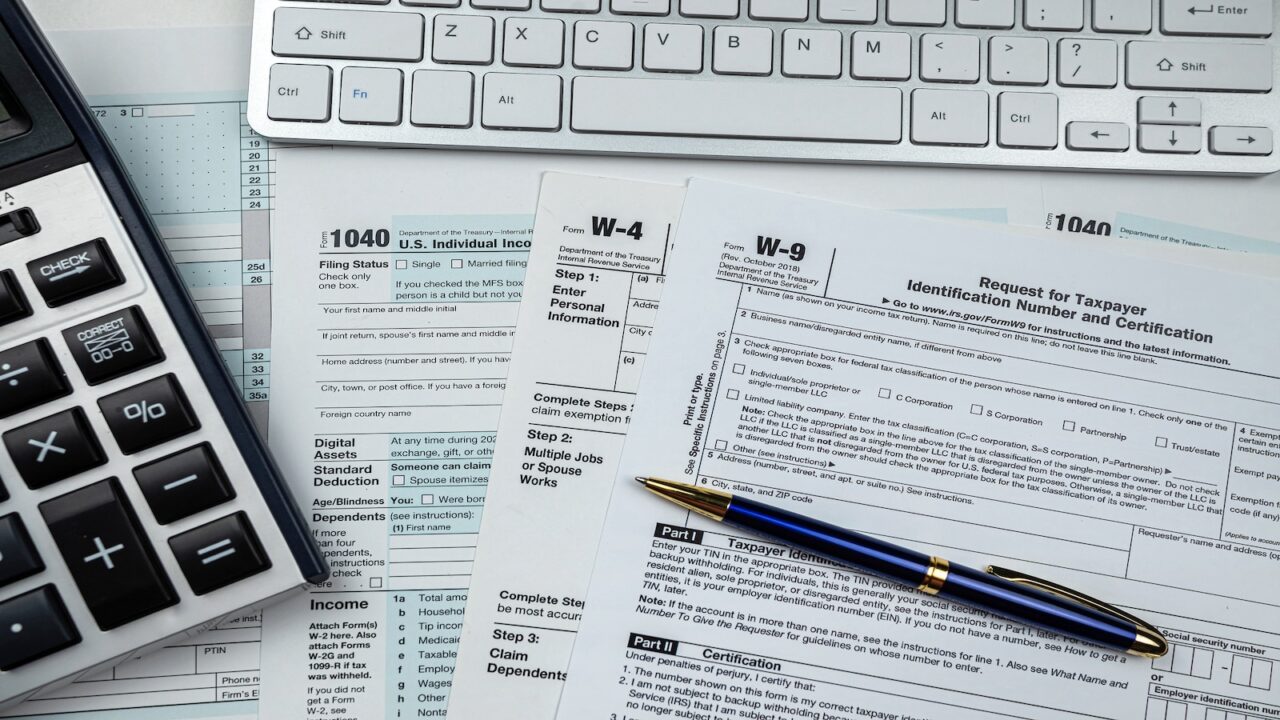

You Still Have Time to Reduce Your 2024 Tax Bill: Here’s How

The year is almost over and before you know it, it’ll be tax time. Now is the time to make those last-minute adjustments to save on your 2024 tax bill.

Whether you’re looking to lower your tax bill or increase your 2024 refund, you still have options. It’s important, however, to make these changes sooner, rather than later, otherwise you will miss out.

Here’s what the financial experts say you can still do.

Increase Your Withholdings

One of the most immediate ways you can lower your obligation or boost a refund is to increase the amount of withholdings in your paycheck. This involves changing your elections on your W-4 form.

This is easy enough to do. Simply contact your human resources department and tell them you need to update your withholdings. The changes should take effect within your next one to two paychecks.

How Much Should You Withhold?

This is a subjective question and the answer will vary depending on whether you’re looking for more money in your pocket now or a larger tax refund. The more elections you list on your W-4, the more money you’ll see in your paycheck, but be warned, that will come due next April.

If you’re looking for a larger refund, you could set your elections to 1, if you have dependents, or zero, if you have none.

Up Your 401(K) Contributions

Any contributions you make to your 401(k) are done on a pre-tax basis. As such, the amount of taxes taken out of your paycheck is lower.

Upping your contributions now can help provide a bit of an upfront tax break and lower your overall adjusted gross income, which means you’ll either have a lower tax bill or larger refund, depending.

How Much Should You Contribute?

Again, like your withholdings, this is a subjective matter, but if you can, you should aim to hit the maximum contribution amount, which as of 2024, is $23,000 for workers under 50.

If you’re 50 and older, you can add an additional $7,500 to help catch up on your contributions and boost your overall retirement fund.

Bunch Deductions

If you regularly donate to charity, you could take advantage of bunching deductions. This means if you know you plan to donate the same amount next year, you can place it into a donor-advised fund (DAF), which is a tax-advantaged account.

If you go this route, make sure you put your donation in the account by December 31. Also, bear in mind that this method only works if the amount you donate will take you beyond the standard deduction.

What Is the Standard Deduction?

The current standard deduction is $14,600 for individuals and $29,200 for married couples. If you’re a head of household, your deduction is $21,900. Next year, it will increase by $400, $800, and $600, respectively.

These amounts are currently inflated due to the Tax Cuts and Jobs Act (TCJA) signed into law by former President Donald Trump in 2017. This measure doubled the standard deduction and is in effect until 2025, when the TCJA expires.

Getting Tax Deductions After the Year Ends

If you find yourself facing a tax bill in April, you can make the choice to contribute to a Roth IRA at that point. You have until the tax deadline to make the contribution.

For 2024, you can contribute up to $6,500. If you’re 50 or older, you can bump this up to $7,000.