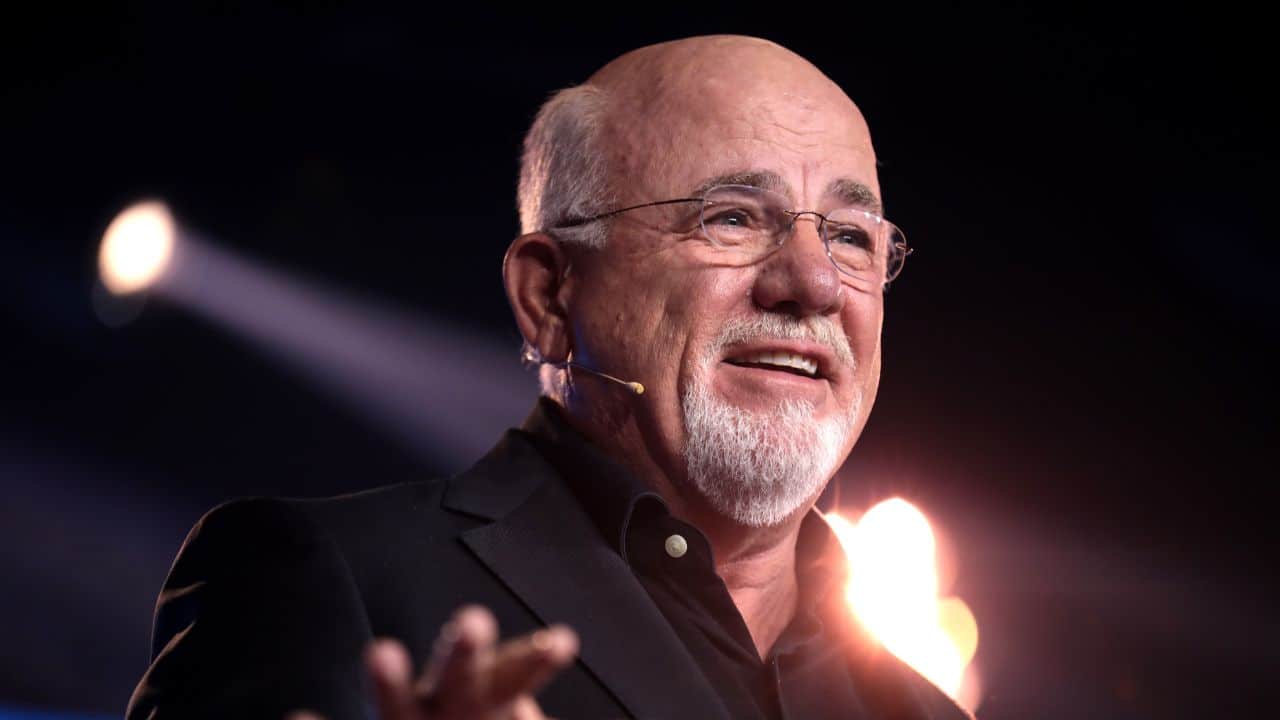

7 Ways To Prepare for a Recession, According to Dave Ramsey

We’ve all heard the word recession. It’s been tossed around left and right in the finance sector, but is there a way to prepare for such an event?

According to Dave Ramsey, yes. The financial guru has been through a few of them, himself, including the Great Recession (2007-2009), and has advice for those looking to set themselves up to weather the storm.

Here are seven things you should do, according to Ramsey, to come out on the other side without losing it all.

1. Budget, Budget, Budget

Even if you’re already on a budget, it’s time to take a closer look. Write everything down. Having it on paper will make it more visual — and sometimes that’s exactly what you need.

Once you have your income and expenses jotted down, see if there’s enough wiggle room to put money away. If there’s not, it’s time to cut the fat. Do away with unnecessary bills and you’ll be surprised at how much money you can free up.

2. Add to Your Emergency Fund

Your emergency fund is so critical. This is money set aside, away from your typical savings, to weather an emergency. This could be a job loss, a decline in income, or a serious injury that requires you to take time off.

The idea is to have between three and six months’ worth of expenses in your emergency fund. That will help get you through most financial events, including a recession.

3. Pay Down Debts

This is so critical. Debt is such a drain on your finances. It’s not just that you owe money to someone else, it’s that you’re paying interest on top of it. And, if your debt is mostly credit cards, you’re paying a lot of money out that you could be saving instead.

Now is the time to pay down debts. Start by sending in more than the minimum payment. That will get the principal down faster, which means less interest. If you have a mortgage, pay a little more each month. Same with a car loan.

4. Don’t Touch Those Investments

Easy there… don’t touch those investments. Just because the market is in a downturn during a recession doesn’t mean it’s time to pull your money out. In fact, you’d be doing a lot more damage if you did.

By their very nature, stock prices rise and fall in typical fashion, even without a recession bearing down. And, the most important thing to keep in mind: investing is a long game. The market will eventually turn, it’s just a matter of how long it takes.

5. Examine Your Finances

This is the time to seriously look at your finances. Are you in good shape? Do you have enough to pay your bills and a little leftover to put in savings?

Any financial decisions you have to make, such as paying off debt or moving money between accounts, now is a good time. The better overall picture you have of your finances, the more equipped you are to make smart money decisions.

6. Make Sure Your Job Is Stable

According to Ramsey, your job is one of the most significant factors in surviving a potential recession. After all, you need money to pay your obligations. Losing your job when things are already on a downturn can be panic-inducing, at best.

If you’re not feeling stable in your position, now is the time to find something more so. If you’re unemployed, it’s time to start looking for a job. There are even side hustles you can take on for extra cash.

7. Avoid Falling into a Panic

Panicking leads to not thinking straight. When you’re not thinking straight, you tend to make less-than-stellar moves, especially with your money. So first, take a deep breath.

Recessions are not uncommon. They’ve happened numerous times over the past few hundred years. Being smart now, by not giving into the fear that’s seemingly everywhere, will get you through the storm.

What Is a Recession?

A recession is a period of economic downturn. Various criteria go into determining whether the economy is headed that way. One of those is the measure of the gross domestic product, commonly referred to as GDP.

If the GDP shrinks for more than a few months, either two consecutive quarters or six months, it could indicate the country is in a recession. The National Bureau of Economic Research Business Cycle Dating Committee is the body responsible for designating the beginning and end of a recession.

How Could a Recession Impact You?

One of the most significant things that can happen during a recession is a rise in unemployment. Businesses also tend to see their growth slow or, shrink in really bad cases.

If you’re working for a company on the cusp of financial decline, you might be laid off, which could contribute to other financial woes. The thing to remember, before you take any drastic action is that recessions are short-term. The economy can and does bounce back.

What Happens to Your Money in the Bank?

This is one major concern people have: is your money safe in the bank during an economic downturn? The answer is yes. You are still protected by the NCUA or FDIC, up to $250,000 per usual.

Some may be tempted to run to their financial institution and withdraw their entire balance. You can certainly do this if you like, but it’s not recommended at all.

How Do You Weather a Recession?

By taking all of Ramsey’s tips we mentioned above, you can set yourself up to weather a recession, should it come your way. The average recession, judged by past occurrences, lasts approximately 17.5 months.

If the US falls into a recession, the biggest thing to do is avoid taking unnecessary risks. Don’t make major purchases, don’t add to your debt.